TT&S Weekly (12/19/22)

Topic of the Week Tipped Workers

Understanding your rights as a tipped employee can be complicated. What if you do tipped and non-tipped work? What if you work overtime? What’s the minimum wage for a tipped employee? 1. Which federal law(s) cover payment of wages to tipped employees?

The federal minimum wage provisions, including those covering tipped employees, are contained in the Fair Labor Standards Act (FLSA). Many states also have minimum wage laws covering tipped employees. For additional information about laws in your state, see the DOL's Minimum Wages for Tipped Employees page, or contact the agency in your state which handles wage and hour/labor standards violations, listed on our site's state government agencies page.

2. Can my employer pay me less in wages because I receive tips?

Yes, under certain circumstances. Under federal law, an employer of a tipped employee is only required to pay $2.13 per hour in direct wages if that amount combined with the tips received at least equals the federal minimum wage. If your tips combined with the employer's direct wages of at least $2.13 per hour do not equal the federal minimum hourly wage, the employer must make up the difference. Many states, however, require higher direct wage amounts for tipped employees, or calculate the offset differently.

Thought of the Week

"The subminimum wage limits millions of workers’ ability to contribute fully to the economy, especially at a time when 86% of restaurant workers nationwide report that tips have decreased since the start of the pandemic. All workers, regardless of whether they’re tipped or not, should be paid at least the state minimum wage."

–American Progress

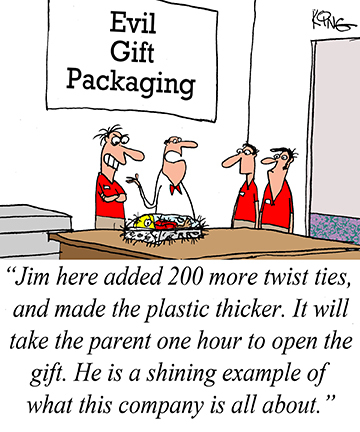

Weekly Comic by Jerry King

Blog of the Week

10 Predictions for Labor in 2023

AI’s menace, institutional failures, and a labor movement basking in energy not seen in decades.

Top Five News Headlines

List of the Week

from